IRS Direct File Pilot FAQ

1. What is the IRS Direct File pilot program?

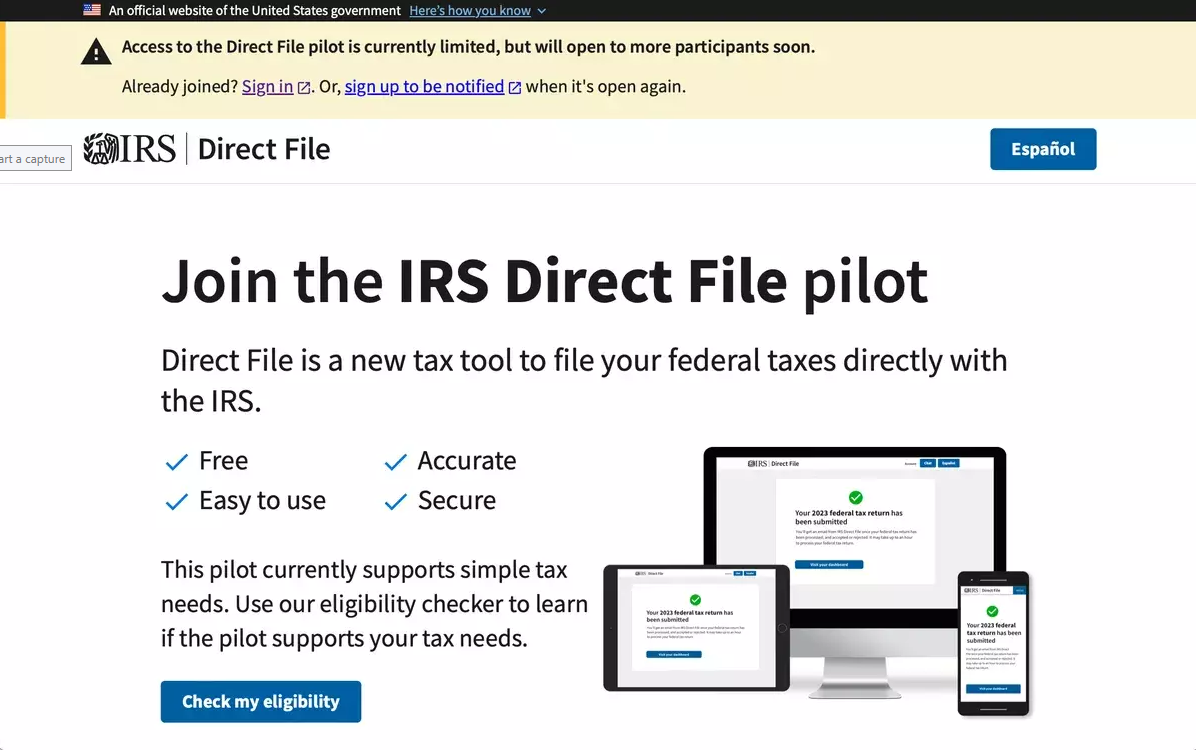

The IRS Direct File pilot is a program allowing taxpayers in select states to file their federal income tax returns directly with the IRS for free.

2. Is the IRS Direct File pilot program available year-round?

No, the pilot program operates in short, unannounced windows throughout the tax season.

3. How can I find out if the IRS Direct File pilot is currently open?

You can check the IRS website or reputable tax news sources for announcements when the pilot program is open for participation.

4. In which states is the IRS Direct File pilot program offered?

The program is currently offered in a limited number of states:

- Arizona

- California

- Florida

- Massachusetts

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington state

- Wyoming

5. Who is eligible to use the IRS Direct File pilot program?

The program is generally intended for taxpayers with simple tax situations. Complex returns with multiple income sources, deductions, or credits might not be suitable for this platform.

6. What are the benefits of using the IRS Direct File pilot program?

- Free: It offers a free alternative to paid tax preparation software or professional tax preparers.

- Convenient: You can file your return directly on the IRS website without needing additional software.

- Secure: Filing directly with the IRS may offer peace of mind regarding data security.

7. What are some limitations of the IRS Direct File pilot program?

- Limited availability: The program operates in short windows throughout the tax season.

- Simpler returns: It may not be suitable for complex tax situations.

- Limited functionality: It might not offer features found in traditional tax preparation software, such as importing past tax data or maximizing deductions.

8. Can I file my state tax return with IRS Direct File?

In some participating states, the program might offer the option to transfer your federal tax information to a state-provided online filing system for your state return.

9. What happens if I make a mistake while filing with IRS Direct File?

You can review and edit your information before submitting your return. However, if you discover a mistake after filing, you might need to file an amended return.

10. Is there any technical support available for the IRS Direct File pilot program?

The IRS website might offer basic troubleshooting information or FAQs related to using the platform. For more complex issues, consider seeking help from a tax professional.

11. What happens to my tax return after I submit it through IRS Direct File?

The IRS will process your return electronically. You can typically track the status of your return on the IRS website.

12. Is my tax information secure using IRS Direct File?

The IRS utilizes security measures to protect taxpayer data. However, it’s always recommended to exercise caution when submitting sensitive information online.

13. Will the IRS Direct File pilot program eventually become a permanent program?

The IRS is evaluating the success of the pilot program. There’s no guarantee it will become a permanent offering.

14. If the IRS Direct File pilot isn't currently available, what other options do I have for filing my taxes?

You can use paid tax preparation software, consult a tax professional, or use the traditional paper forms and mailing system.

15. Where can I find more information about the IRS Direct File pilot program?

The IRS website is a valuable resource: https://www.irs.gov/about-irs/strategic-plan/irs-direct-file-pilot